Anyone buying stock in Honda?

#1

Anyone buying stock in Honda?

I've been buying shares of Honda stock every month for the last 6 months (dollar cost average investing). Its done very well and is now up about 20 percent since the first of the year. Of course blue chip stocks like Honda won't continue to grow at this rate forever, but I wanted to bring to everyones attention that imho this will be a good long term investment, helped by their diversified interests and the fact they have lots of great new models coming out in the next 3 years. Apparently Wall Street liked Honda's sales figures just released and their stock went up over 6 percent just today!

#4

God no, anybody with common sense is invested in energy right now :) lol, jk.

I used to play around in the market, did ok. Best stocks I ever had were Canadian energy trusts until the government shut down that gravy train.

If my experience has told me anything, it is that eventually you will loose big time if you play too long. Stocks are basically educated gambling.

I used to play around in the market, did ok. Best stocks I ever had were Canadian energy trusts until the government shut down that gravy train.

If my experience has told me anything, it is that eventually you will loose big time if you play too long. Stocks are basically educated gambling.

Last edited by Sugarphreak; 06-06-2008 at 01:45 AM.

#5

One issue with playing with foreign stocks is that it is also affected by the exchange rate. If the dollar sucks (like it does now) the stock is more expensive and as the dollar goes stronger, it can bite into your profit.

#7

Honda's hedge against the fluctuation of the dollar is why they have so many plants in the US, and around the world.

#8

God no, anybody with common sense is invested in energy right now :) lol, jk.

I used to play around in the market, did ok. Best stocks I ever had were Canadian energy trusts until the government shut down that gravy train.

If my experience has told me anything, it is that eventually you will loose big time if you play too long. Stocks are basically educated gambling.

I used to play around in the market, did ok. Best stocks I ever had were Canadian energy trusts until the government shut down that gravy train.

If my experience has told me anything, it is that eventually you will loose big time if you play too long. Stocks are basically educated gambling.

#11

Well, the Civic was the most sold vehicle for the month of May beating Chevy and Ford! So that is good - best investments are mutual bonds and securites then dapple lightly in the stock market - to avoid losing too much of your investment.

Cat :x

Cat :x

#12

It's all going Pete Tong!

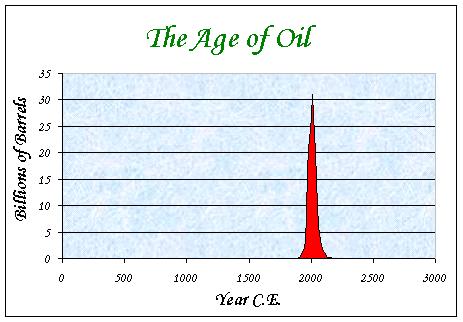

I would be cautious about putting all your eggs in one basket, much as I love Honda. The car industry will be facing some tough times ahead due to oil prices and the credit crunch.

Check the link below:

Amazon.co.uk: peak oil

If you don't want to read books, there's a video by a comedian, who tries to make the end of the oil age as funny as possible, while also giving you things to think about: The History of Oil - Robert Newman

You may want to look at the arguments for and against "Peak Oil". This is what happens when the world has used over 50% of its reserves and is left to squabble over the dwindling remains. Economic growth depends on ever more energy. If available energy declines, growth goes into reverse (think smaller house, smaller car, eventually cant afford to run computers and tvs etc). I am 80% convinced that the Peak-oilers are right and we are running out of economically-recoverable oil because a number of things don't quite add up: the IEA assume an infinite supply of oil, and base their estimates of reserves on demand; OPEC countries are 'choosing' not to increase supply, even though doing so would bring in much needed extra income; official OPEC reserves haven't changed in decades despite relentless drilling; as oil producing countries' economies grow, they will consume more of their own oil; there is no viable substitute to oil; official uranium and coal reserve figures are also suspect.

If we are heading for an energy crunch, I would invest in gold to ride out the consequences. But on the other hand, there could be a technical solution in the form of solar power or algae biofules etc. But if there isn't, I would also invest in public transport (buses and trains but not planes).

Check the link below:

Amazon.co.uk: peak oil

If you don't want to read books, there's a video by a comedian, who tries to make the end of the oil age as funny as possible, while also giving you things to think about: The History of Oil - Robert Newman

You may want to look at the arguments for and against "Peak Oil". This is what happens when the world has used over 50% of its reserves and is left to squabble over the dwindling remains. Economic growth depends on ever more energy. If available energy declines, growth goes into reverse (think smaller house, smaller car, eventually cant afford to run computers and tvs etc). I am 80% convinced that the Peak-oilers are right and we are running out of economically-recoverable oil because a number of things don't quite add up: the IEA assume an infinite supply of oil, and base their estimates of reserves on demand; OPEC countries are 'choosing' not to increase supply, even though doing so would bring in much needed extra income; official OPEC reserves haven't changed in decades despite relentless drilling; as oil producing countries' economies grow, they will consume more of their own oil; there is no viable substitute to oil; official uranium and coal reserve figures are also suspect.

If we are heading for an energy crunch, I would invest in gold to ride out the consequences. But on the other hand, there could be a technical solution in the form of solar power or algae biofules etc. But if there isn't, I would also invest in public transport (buses and trains but not planes).

#13

I beg to differ, Sugar. If you buy high and sell low, getting out early you can lose big time. But investing and holding for a long time, history shows good returns. Just look at the value of the Dow stocks for the last 100 plus years. Warren Buffet's investing philosophy is never sell and hold forever. Thats worked pretty good for him.

If you can actually buy low and sell high it would be pretty impressive. Most people buy on emotion, selling when the stock crashes and buying when it is popular. Everybody says it, but nobody ever follows it. I can see Honda stocks going up based on market conditions and high oil prices, yet Honda makes a lot of cars in Canada which is being hurt in the auto sector very badly by the high dollar (as a result of oil prices). Seems like a trendy choice IMO. If you put your money in and leave it for 5 years you will make some profit.

I actually did well buying low and selling high. Studied the stockscores Stock Market Scanning, Online Video Training for Traders and Technical Analysis of Stocks at Stockscores.com, followed trends like a hawk, tried to stay one step ahead of the rest of the traders. After +20 successful trades over 3 years that netted me over 250% in total profits I got slammed just once and finally just called it quits with only a little bit of profit.

Even if you try to play the long term there will always be another depression or some other world event that ruins 10 years of profit. I know lots of people I work with who lost 40% of their retirement only a couple of years from calling it quits thanks to 9/11.

Don't kid yourself, it is educated gambling unless you have an inside source. My best tips are to invest in industry's you are intimately familiar with because that gives you a huge advantage even though it dosn't seem like it.

I gave up on the stock market and moved my money into real estate. if you consider after tax cash, I made more than 10 years worth of salaries in the last year. Much more predictable than stocks I find. Everything moves slow, you can see a housing crash coming a mile away and booms last at least 2 to 3 years.

Last edited by Sugarphreak; 06-07-2008 at 01:12 PM.

#14

If your new to investing this is a good start at understanding the fundamentals Investment Guide

#17

lol, flattery will get you nowhere :)

I am no guru, but I might have a tip or two ;) You got PM'd!

Biggest question mark right now is where oil is going to go because it is going to start affecting inflation if it doesn’t pull back... which in turn will have an impact on the interest rates.

Since about last summer I was expecting interest rates to start dropping off starting at the beginning of this year right into the summer before they held steady for a while. So far so good, actually I can't believe how much the US feds slashed rates to try and avert a recession. Canada has cut, but not to the same extremes. I am still thinking this Fall will have a slight increase in rates.

You guys get to write off your mortgage payments in the US right?

I am no guru, but I might have a tip or two ;) You got PM'd!

Biggest question mark right now is where oil is going to go because it is going to start affecting inflation if it doesn’t pull back... which in turn will have an impact on the interest rates.

Since about last summer I was expecting interest rates to start dropping off starting at the beginning of this year right into the summer before they held steady for a while. So far so good, actually I can't believe how much the US feds slashed rates to try and avert a recession. Canada has cut, but not to the same extremes. I am still thinking this Fall will have a slight increase in rates.

You guys get to write off your mortgage payments in the US right?

#18

lol, flattery will get you nowhere :)

I am no guru, but I might have a tip or two ;) You got PM'd!

Biggest question mark right now is where oil is going to go because it is going to start affecting inflation if it doesn’t pull back... which in turn will have an impact on the interest rates.

Since about last summer I was expecting interest rates to start dropping off starting at the beginning of this year right into the summer before they held steady for a while. So far so good, actually I can't believe how much the US feds slashed rates to try and avert a recession. Canada has cut, but not to the same extremes. I am still thinking this Fall will have a slight increase in rates.

You guys get to write off your mortgage payments in the US right?

I am no guru, but I might have a tip or two ;) You got PM'd!

Biggest question mark right now is where oil is going to go because it is going to start affecting inflation if it doesn’t pull back... which in turn will have an impact on the interest rates.

Since about last summer I was expecting interest rates to start dropping off starting at the beginning of this year right into the summer before they held steady for a while. So far so good, actually I can't believe how much the US feds slashed rates to try and avert a recession. Canada has cut, but not to the same extremes. I am still thinking this Fall will have a slight increase in rates.

You guys get to write off your mortgage payments in the US right?

#20

No, I am not buying stock in Honda. I'm done with buying stocks. It takes way too much willpower to not constantly buy, sell, bend over, and take it. I recently moved nearly all of my investments into a few nice mutual funds, managed by people who have decades of experience and whose sole job is to make me money.

I never liked mutual funds, the fact they don't have to disclose what is actually going on behind the scenes bothers me. There is also risk in those as well :(

My investments are mostly tied up in Market GIC's, basically a reasonable guaranteed return with the benefits of a market bonus. So far they have been averaging 9%-14% per year over the past 5 years.

Thread

Thread Starter

Forum

Replies

Last Post

Surviver of the Fittest

2nd Generation (GE 08-13)

7

02-04-2009 02:02 AM

ride_the_pony69

Car Shows, Events, and Racing

18

06-11-2007 07:22 PM